Vicki会计培训Public Practice课程

入职Accounting Firm的必修课

Vicki 会计培训中心是澳洲会计培训行业的No1. 多年来,求职成功率在行业内稳居第一,凭借多年教学经验和敏锐的市场嗅觉,以追求学员高就业率为己任,大胆创新,紧贴市场,严格审编教学内容,精心施教,务求高效实用,速出成果,帮助同学们用最短的时间找到首份工作.

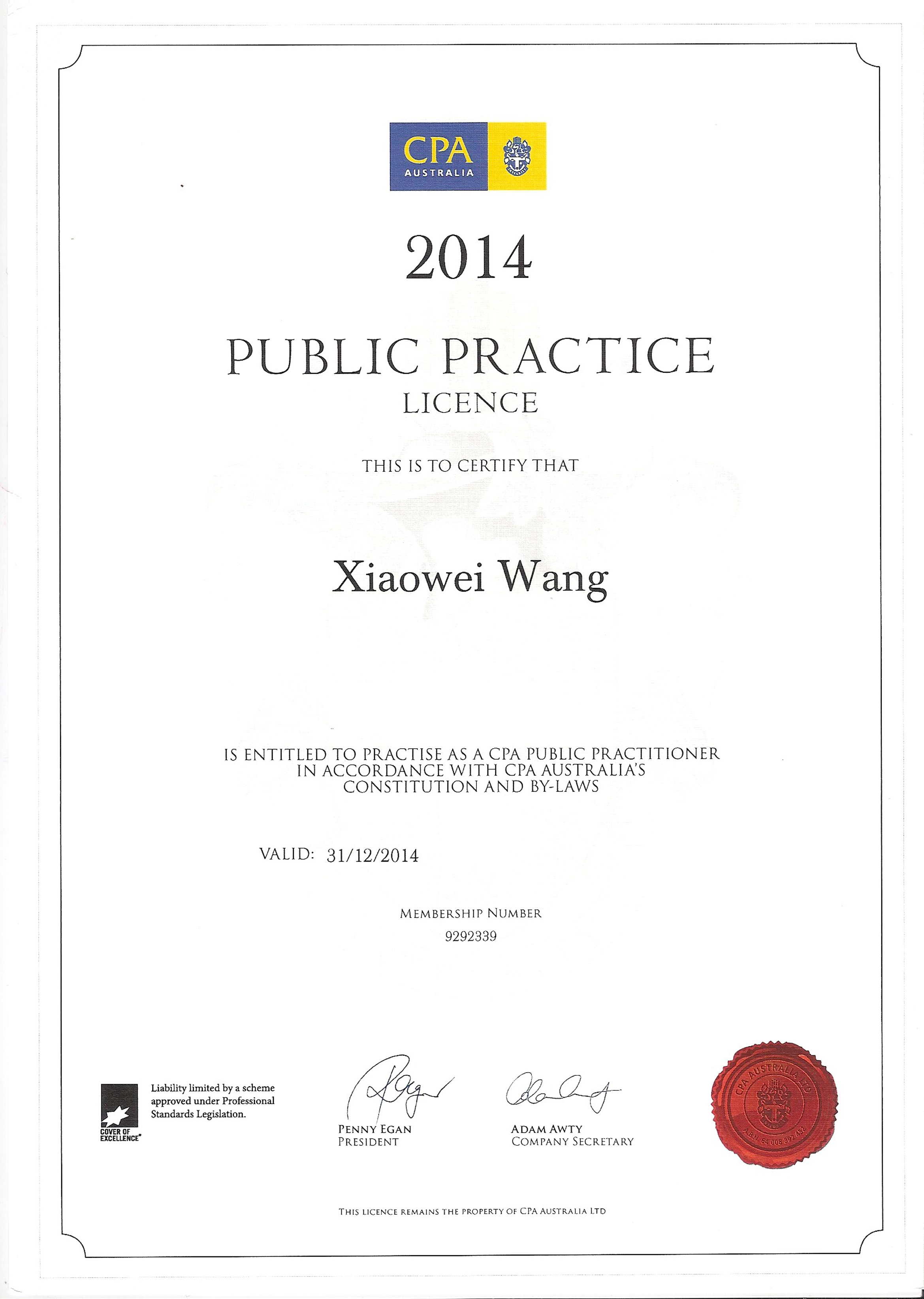

Public Practice课程是为想去Public Practice领域发展的学员量身定制的,内容包含Accounting Firm工作需必需的应知、应会知识,教材由本中心资深CPA 编写,经反复修改、补充后由Vicki审定,内容由浅入深,循序渐进,确保学员易学,易懂。PP课程在我们整个培训课程中耗时最长,有8节课组成,每节课4小时,总课时达32小时,内容信息量大,涉及面多、覆盖了整个会计事务所的基本工作。

我们的PP课程讲究高效,实用,真材实料,不掺水份,每节课都由本中心资深Trainer连续讲解达4-5小时,不含任何Practice时间。我们会运用真实case来讲述和处理不同的Business Structure的流程和规则,并布置大量Case回家练习,让大家熟悉会计事务所工作环境,相比到会计事务所去实习,能学到的东西更多,效率更高。

我们的师资来自于澳洲大、中型会计事务所,职场经验丰富,见识广,实际工作案例分析到位,讲解通俗易懂,包教包会,相信这一切都会成为学员们今后找工和工作的一笔宝贵财富。

Handisoft是会计事务所的专用财务软件,工作中会时刻用到它,我们提供Handisoft正版软件并免费安装到你的电脑中,当你需要练习时,可以随时随地利用自己的电脑在课余时间登陆操作,而不必占用上课时间。

一份出彩的简历能大大提高你的出镜率,使你得到更多的面试机会, 为了让你的简历更有吸引力,我们免费提供简历个性化修改,让你的简历精益求精,更能获得雇主的青睐,为轻松找到第一份工作打好基础。

我们提供课程免费重听,如果你对某节课程的理解还不甚清楚,你可以通过Email询问,也可以随时来校调看课堂录相,还可以申请再次重听课程,直到你完全掌握知识为止。

考虑到同学们是刚毕业的学生,还没有经济来源,为让更多正在找工的学员从我们的课程中受益,Vicki会计培训所有课程的学费都大大低于市场价,Public Practice课程32学时学费仅$1450。

在经历了8个session高效率的培训后, 我们的课程已经帮助你积累了相当于1-2年的会计事务所工作经验了,对Accounting Firm的各种操作流程,你都能驾轻驭熟,得心应手,现在,您可以广投简历去职场驰骋了!

Public Practice课程设置

Case 1:Partnership (Session 1)

1, Introduction of different businessstructures –partnership, sole trader, company and trust

2, Introduction of softwares – HandiTax andHandiLedger

3, GST registration and GST accountingmethods

4, Business Activity Statement and AnnualGST return lodgment

5, Instalment Activity Statement lodgment

6, Process Excel data and post data to Handiledger

7, Run Handiledger BAS report and transferto Handitax

8, Partnership accounts and reports

9, Partnership tax return

10, PAYG payment summaries and statement,Reportable employer superannuation contribution

11, Small business benchmark

Case 2:Sole Trader (Session 2)

1, Individual tax return main form

2, Donation deductions

3, Four method of claiming motor vehicleexpenses

3, Business worksheet

4, Depreciation worksheet and general pool

5, Capital Gain worksheet, CGT schedule,Capital loss application

6, HECS/HELP loan

7, PAYG Income tax instalment

8, Definition of Small Business Entity

9, SBE Income tax Concession:

¢ Cash accounting method

¢ Simplified trading stock rules

¢ Immediate deductions for prepaid expenses

¢ Two-year amendment period

¢ Simplified depreciation rules

10, SBE new policy from 1 July 2012

11, Entrepreneurs tax offset

12, Claim personal superannuation deduction

13, Personal Service Income

14, Tax return amendment

Case 3:Company (Session 3 and Session 4)

1, Officeholder’s legal obligation

2, Company’s minutes and resolution

3, Process MYOB data to Handiledger

4, Check MYOB management accounts

5, Run various MYOB reports

6, Bank reconciliation

7, Reconcile trade debtors and creditors

8, Prepare BAS summary and reconcile GST

9, Reconcile inventory value, perpetualinventory and periodic inventory methods

10, MYOB year end adjusting entries

11, Reconcile accounting profit and taxprofit

12, BAS amendment

13, Franking account

14, Loss schedule

15, Company accounts and complete financialstatements

16, Income tax return (Year 2 using SmallBusiness Entity tax treatment)

17, Fringe Benefits Tax introduction

18, FBT calculation: Car – Statutory methodand operating method

19, Prepare simple FBT return

Case 4:Trust (Session 5 and Session 6)

1, Trust introduction

2, Trust elements (Trustee, Trust deed,Beneficiary, Settlor, Appointer)

3, Different types of trust

4, Compare individual trustee with companytrustee

5, Non–resident beneficiaries

6, Taxation treatment of trust

7, Reconcile trust income with investmentannual taxation statement

8, Reconcile dividends (unfranked dividend,franked dividend)

9, Calculate share closing stock usingExcel Subtotal and Pivot Table functions

10, Margin lending interest

11, Rental property schedule

12, Capital Gain Tax for shares and rentalproperty

13, Capital works deduction and quantitysurveyor report

14, Trust accounts and financial statements

15, Trust tax return and distribution

Case 5:Comprehensive case (Session 7 and Session 8 )

1, Difference between Lease, Hire Purchase& Chattel Mortgage

2, Set up Hire purchase Schedule

3, Borrowing expense and formation expensededuction

4, Division

5, Division

6, Division

7, Employee contribution (FBT)

8, Bad debt expenses

9, Transfer from Handiledger account toHanditax return

10, Working paper, checklist and job budget

11, Demonstrate other Handisoft application– Time & Billing, Jobflow Manager, Document Manager, Handiregister, WeeklyPlanner

12, ATO Tax portal and Pre-filling report

联系我们

电话咨询: 0432208783 (02)80682467

上门咨询: 请电话预约

悉尼校区: Level1,

墨尔本校区:level 1,131 Queen St,Melbourne

欢迎浏览我们的网站: http;//www.Vickiaccounting.com.au